The California Percentage Of Income Penalty For Not Having Health Insurance Is Based On

This is separate from the zeroed out federal penalty and your consumers should know the penalty for a family not having insurance in 2020 could be 2000 or more. Covered California subsidy is greater than the cost of the health insurance.

Health Insurance Companies In California Covered California

Health coverage is unaffordable based on actual income reported on your state income tax return when filing taxes.

The california percentage of income penalty for not having health insurance is based on. If you arent covered and owe a penalty for 2020 it will be due when you file your tax return in 2021. Of course the greatest penalty is choosing to go without insurance and then receiving an emergency hospital. If youre 30 or older and want a Catastrophic health plan you must apply for a hardship exemption to qualify.

The chosen method for the penalty will be based on whichever. Pay a penalty when filing a state tax return or. Under the new California state law the failure to obtain minimal coverage before January 1 2020 will result in penalties of.

What is the Penalty for Not Having Health Insurance. The penalty for having no health insurance in California will be 695 for an adult and 50 of that for each additional dependent but uninsured child or 25 percent of household income whichever figure is larger. To avoid a penalty you will need qualifying health coverage for each month beginning on January 1 2020 for.

Some people with higher incomes instead will have to pay 25 of their income which could make their penalty quite a bit heftier. A family of four that goes uninsured for the whole year would face a penalty of at least 2250. Beginning January 1 2020 all California residents must either.

695 per each adult in a household as well as 34750 per each child. This means that some individuals could face a. See details about exemptions and catastrophic coverage.

California utilizes two different ways to assess insurance penalties. Have qualifying health insurance coverage or. The penalty for not having coverage the entire year will be at least 750 per adult and 375 per dependent child under 18 in the household when you file your 2020 state income tax return in 2021.

This same family with an income of 200000 is. You can also get insurance other ways through a private insurance company an online insurance seller or an agentbroker. It doesnt matter if youre low-income or high-income or if you fall somewhere in between2017s Tax Cuts and Jobs Act TCJA dealt the penalty known as the shared responsibility payment a death blowThe ACA itself is still alive and well but the TCJA.

Get an exemption from the requirement to have coverage. Do a quick check to see if you may save. You may either be charged a flat amount of 695 for each adult or 34750 for each child without insurance or you may be charged 25 of your gross income that is in excess of the filing threshold in the state.

The fee for not having health insurance no longer applies. Since the percentage of household income was higher than the flat amount the penalty amount for this family is 252288. Beginning January 1 2020 a new law requires all California residents to have health insurance or pay a penalty.

Have qualifying health insurance coverage. California individual mandate penalty for a household of 4 100k income no health insurance estimated at 2085. Most of the states with individual mandates have modeled their penalties on the federal penalty that was used in 2018 which is 695 per uninsured adult half that amount per child up to 2085 per family or 25 of household income above the tax filing thresholdm although there are some state-to-state variations.

Obtain an exemption from the requirement to have coverage. Cost of the lowest-cost Bronze plan through Covered California or the lowest cost employer-sponsored employee-only plan is more than 827 percent of income in 2021 on the tax return. Pay a penalty when they file their state tax return.

The penalty for not having coverage the entire year will be at least 750 per adult and 375 per dependent child under 18 in the household when you file your 2020 state income tax return in 2021. Get an exemption from the requirement to have coverage. Starting in 2020 California residents must either.

The penalty will amount to 695 for an adult and half that much for dependent children. 49085 is the state filing threshold for a married couple both under 65 years old with one dependent for the 2019 tax year. If youre not eligible for lower costs on a health plan because your income is too high you can still buy health coverage through the Health Insurance Marketplace.

The federal individual mandate health insurance penalty imposed by the Affordable Care Act ACA no longer exists for any American. We now have these penalty levels for Californians. Part of health reform mandates the purchase of health insurance for most people and it creates both subsidies to help purchase it for those individuals up to 400 of the federal poverty level about 93K for a family of four and penalties for those individuals who choose not to purchase health insurance across all income levels.

If you dont have coverage you dont need an exemption to avoid the penalty. According to the California Franchise Tax Board FTB the penalty for not having health insurance is the greater of either 25 of the household annual income or a flat dollar amount of 750 per adult and 375 per child these number will rise every year with inflation in the household. The penalty for not having insurance will mirror the one under the Affordable Care Act which was 695 per adult and 34750 per child under 18 or 25 of annual household income.

Find Affordable Health Insurance And Compare Quotes

How Much Should I Pay For Healthcare Healthcare Affordability Ratio

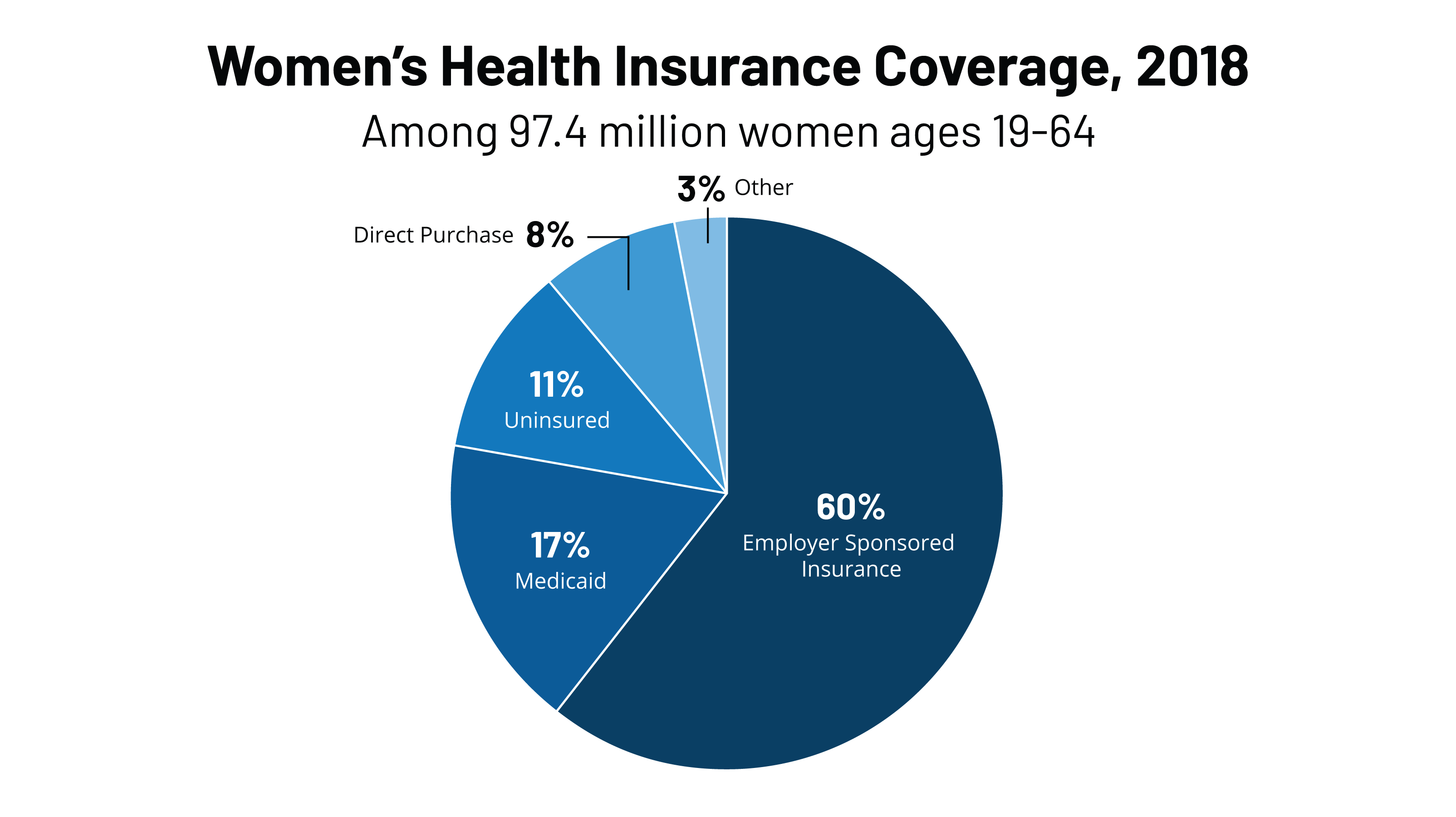

Women S Health Insurance Coverage Kff

How Much Does Individual Health Insurance Cost Ehealth

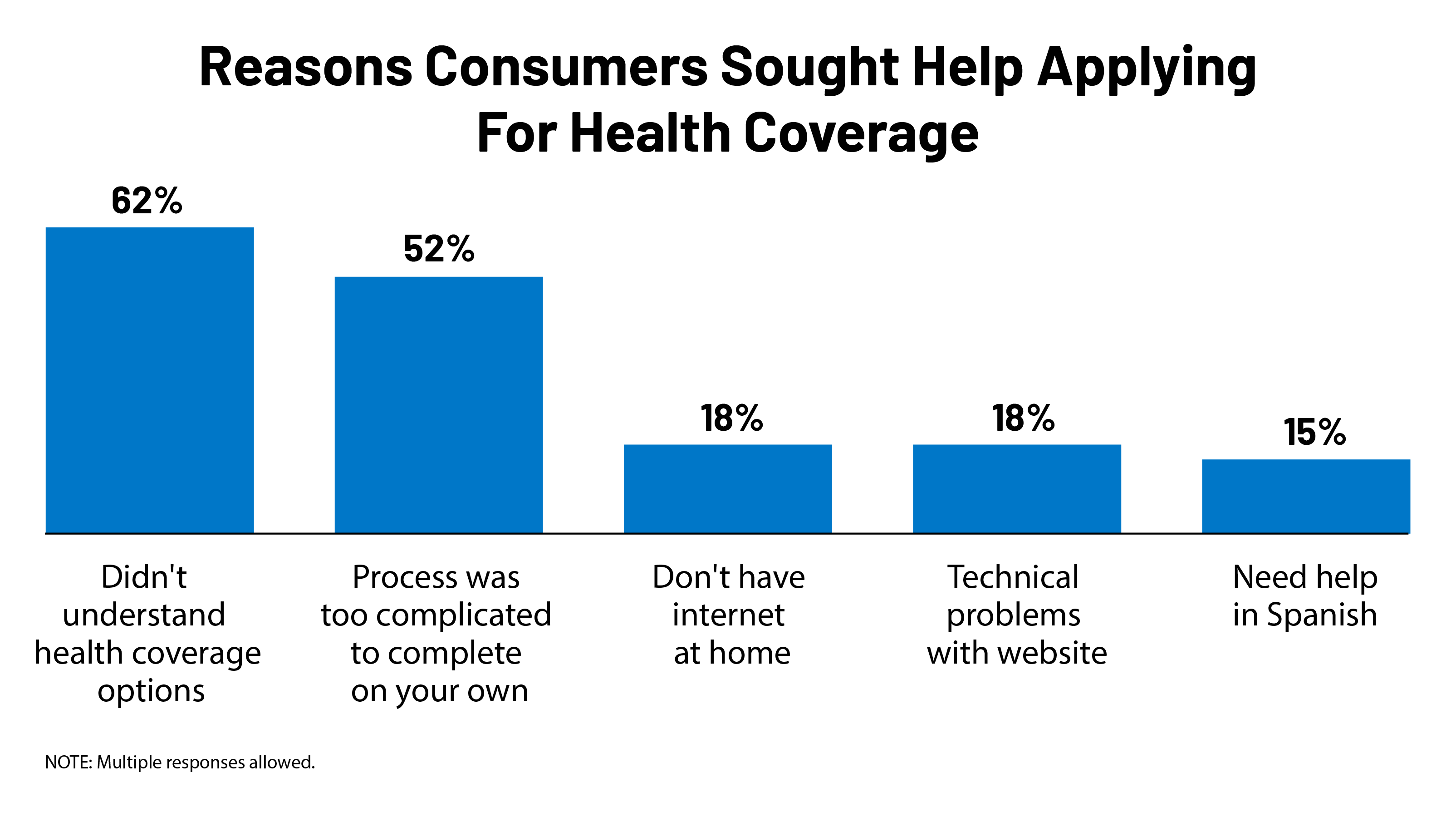

Consumer Assistance In Health Insurance Evidence Of Impact And Unmet Need Issue Brief 9511 Kff

Explaining Health Care Reform Questions About Health Insurance Subsidies Kff

Open Enrollment 2022 Guide Healthinsurance Org

Self Employed Health Insurance Deduction Healthinsurance Org

Small Business Health Insurance Requirements 2021 Ehealth

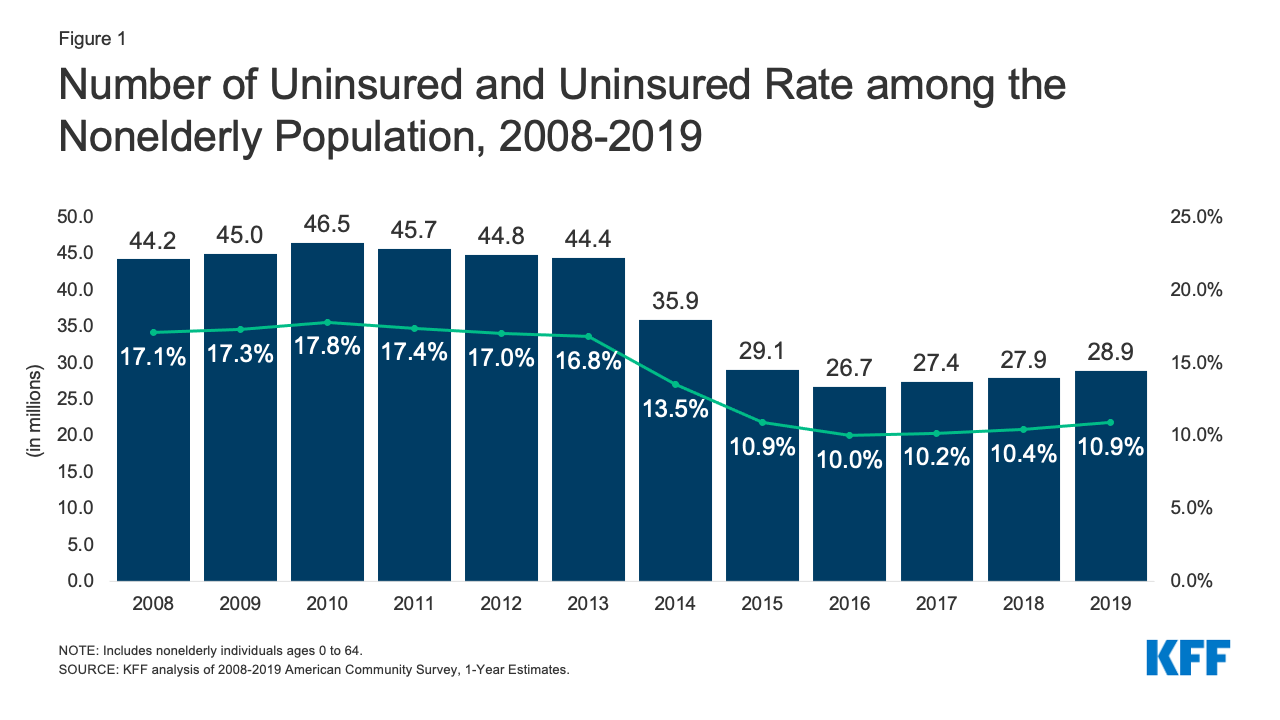

Key Facts About The Uninsured Population Kff

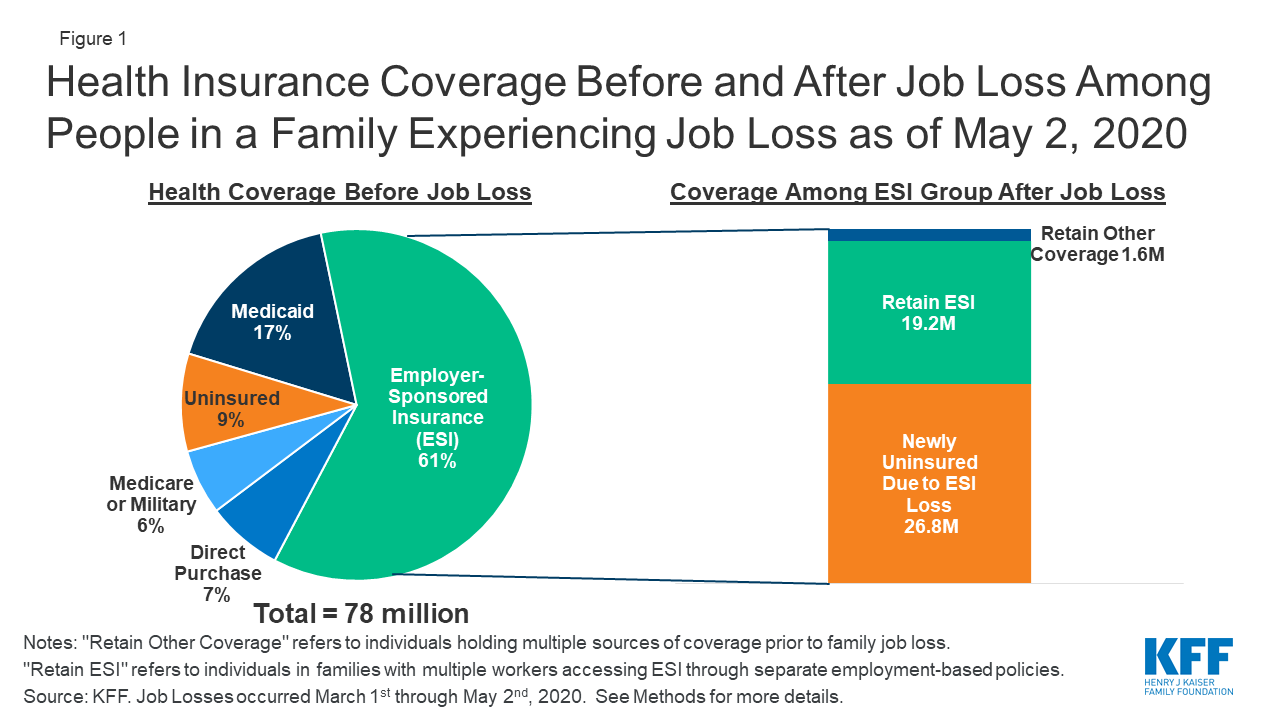

Eligibility For Aca Health Coverage Following Job Loss Kff

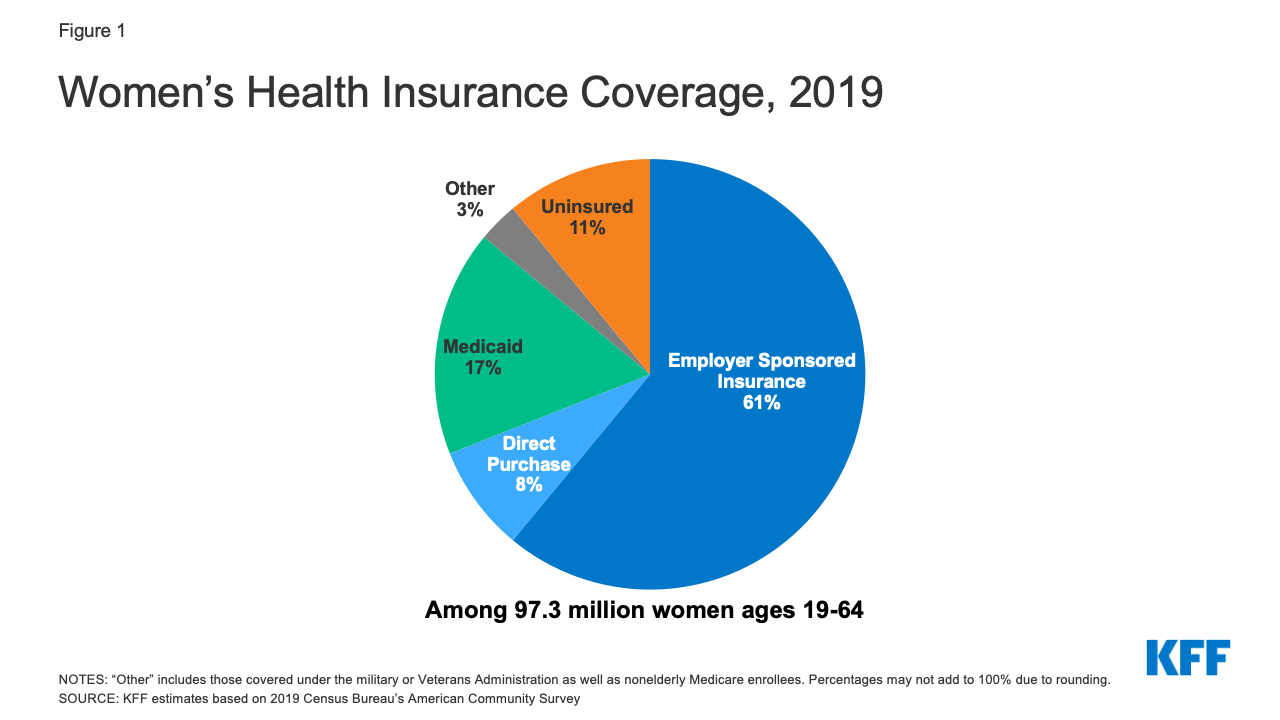

Women S Health Insurance Coverage Kff

How Age Affects Health Insurance Costs Valuepenguin

Different Types Of Health Insurance Plans

Health Insurance Marketplace Calculator Kff

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

The 2020 Changes To California Health Insurance Ehealth

Are Mental Health Services And Therapy Covered By Health Insurance Goodrx

/GettyImages-1036290704_2400-a0add133324a4892b365358ab661634e.jpg)

Post a Comment for "The California Percentage Of Income Penalty For Not Having Health Insurance Is Based On"